A “tool” that is often forgotten when practising technical analysis, is the volume. E.g. how much “fuel” does it take to move the price in one or the other direction X points / percent.

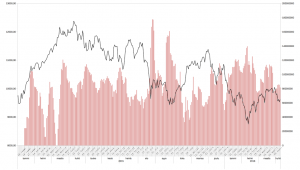

Below two quite simple ideas; first one is volume difference between two days (today – yesterday). The second is 5 day average volume (i.e. a “normal” trading week).

Volume doesn’t “tell” per se what will or could happen but when volume changes drastically (i.e. volume spikes etc.), it should be a heads up that big traders ( = institutional investors aka smart money) are active.

To simplify, institutional investors seldom buy stocks with both hands if the underlying instrument has done a parabolic rally for several weeks or months. And vice versa, smart money doesn’t dump stocks at “oversold levels”. I hate the definition oversold but anyhow, you get the point.. These deep pocket big guys are the ones that make trends.. ..and also the first ones that changes the trend..