We should expect consolidation or pullback as soon as monday/tuesday of the coming week. Non-volatile pullback is “buy the dip”. Weekly close below SPX 1400 is a heads up and is among the first signs of a trend reversal sign based on price action.

SPX 1400 is also a “magic level” and around this level, odd price action should be expected. In other words, not a good stop/loss level.

On a 60min chart, this is my best guess for the short term.

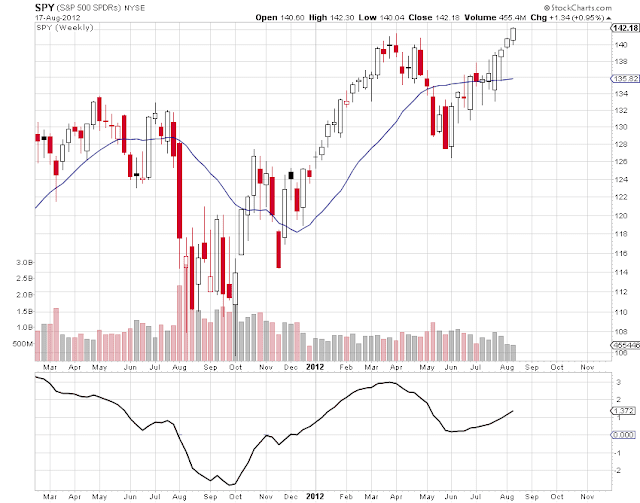

Below a SPY weekly chart, notice low volume

Estimated weekly range: 1385 – 1440.

VIX is low, SPX volatility is very low and that makes me think that the upside potential is very limited and a correction is needed. My trading suggestion is to take profit on longs or protect with puts. Shorting is though front running at this stage and should only be traded with smallish positions.

From the trading signal site:

Weekly BPSPX = bullish

Daily BPSPX = bullish

SPX EMA = bullish

SPX MA200 = bullish

Weekly SPX MACD = bullish

GOLD MA200/300 = bearish