DAX – VOLUME SPIKES

We had a volume spike yesterday on the daily DAX chart. An interesting observation once again over the past week, is what the financial news publishes. A bigger financial news paper publishes “stocks are selling of sharp due to brexit fears…” and the next trading hour large market indexes are >+1%. I’d say that it is better not to read these so called important market news at all. Usually the information doesn’t give you an edge trying to decide shall I buy or sell.

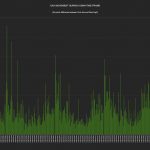

Interestingly enough, we have had these brexit -events (or whatever excuse they come up with for larger price movements) quite often over the last 1.5 year period. On the chart below, the red bars represent a volume spike that was close to the volume we had yesterday. As you can see, the activity had nothing todo with brexit or some other bull$h1t news but only larger traders being very active in the markets. The saying “buy fear & sell greed” isn’t that bad of an advice, it seems.

OK – thank you for the ground breaking info and sharing the holy grail with me, you are probably thinking; now WTF shall I do with this important knowledge? Well – large traders are not always right, although they also like to buy cheap and sell at higher prices. Unlike you and me, these large traders usually are the ones setting trends due to their large positions.

That is, bigger volume (and volume spikes) should be seen closer to significant tops and bottoms. Now, DAX has dropped ~900 points in a quite short time and my guess is, that yesterday volume spike was not “smart money large traders” dumping their long positions but that is me speculating.

What we can expect with high probability though for the close future, is a bigger move coming up. Currently my guess is that move will be on the upside but time will tell.

…and yes, the brexit vote incoming week is a big mile stone for the EU project. And yes, there will likely be big price moves the incoming ~1-2months in the markets (not only due to what goes on within EU but also the elections in the US).