MARKET THOUGHTS

Let’s dig right into the market and charts. First off DAX.

The trend is obviously up but volatility is perhaps a bit high for “safe bull” market (~100 points / daily). The index is also quite high above its moving average of 200 days (@7155 points), sooner or later it will try the average. Usually DAX tries this average at least once a year, the question is though when.. First better support level is @ 7500.

Cumulative NYSE advance – decline volume is not yet suggesting market top. It is still suspicious when it shoots up in the air like this..

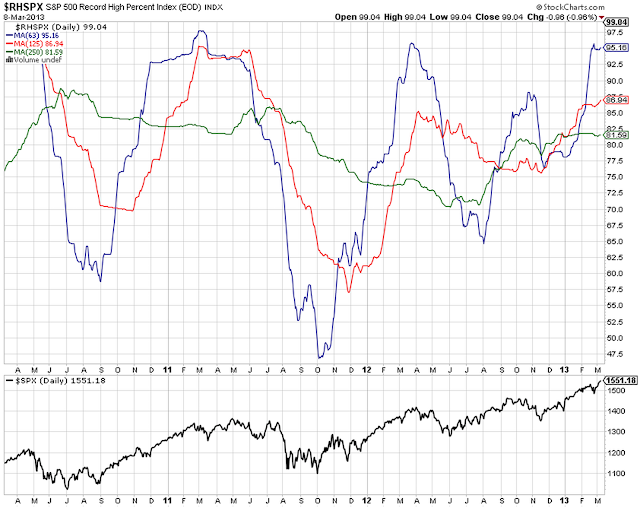

$RHSPX is also high, look at the pattern the last 3 years

SPX stocks above MA50. Below 70% is usually a heads up.

Tomorrow I’ll post more thoughts, more focus on money and volume flow.

Have a great weekend!